During the pandemic, we heard the word “unprecedented” an unprecedented number of times. These days, the term has started resurfacing — in the real estate world. The question relocating employees ask at the beginning of their relocation process is often “Will I buy a new home or rent one?” which may have to be slightly reframed to ask “What can I afford to do…buy or rent?”

My inbox today shared the latest insights from LendingTree, with the primary point being that the Average Down Payments on Homes Across 50 Largest US Metros Top $84,000. The top 3 most expensive locations are in California where the average down payments in San Jose and San Francisco are $237,600 and $228,951, respectively — making the two tech hubs the only in our study where down payments top $200,000. While not quite as steep, the average down payment in Los Angeles is still high at $157,557. Across the country, it is particularly bad for first-time homeowners as an average down payment on a home across the nation’s 50 largest metros equates to 71.48% of that area’s average annual household income. Per LendingTree, “While there are likely exceptions — like instances where people rely on profits from a past home sale to pay for a down payment on a new place — this figure suggests saving for a down payment is going to be, if nothing else, a time-consuming endeavor in most areas.” Regardless of whether a would-be buyer owns or rents, needing to come up with a lot of cash for a down payment can make the homebuying process more difficult and time-consuming.

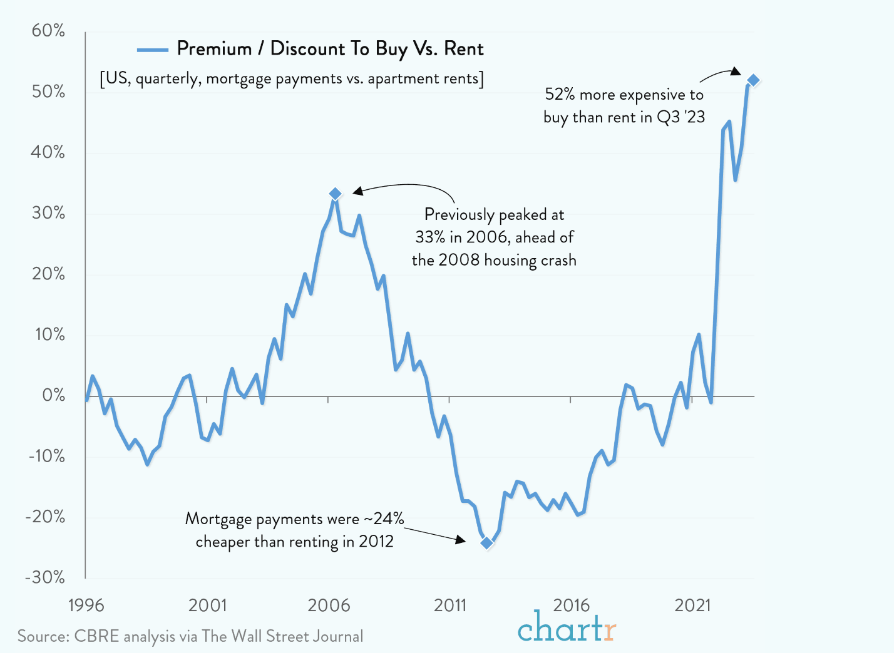

Adding in the increase in mortgage rates, we now have a full-on renters market. This information from Chartr provides data that shares the reality that answering the question of “do I buy or rent” has never been more clear cut, albeit more depressing for those relocating, especially those that own a home and wanting to hold onto their lower mortgage rate. Their recent newsletter shares that:

CBRE analysis, cited by the WSJ, suggests that average new monthly mortgage payments are now 52% more expensive than typical rent on an apartment in the US. This disparity is now the most pronounced that it’s been across the 27-year span of CBRE’s research.

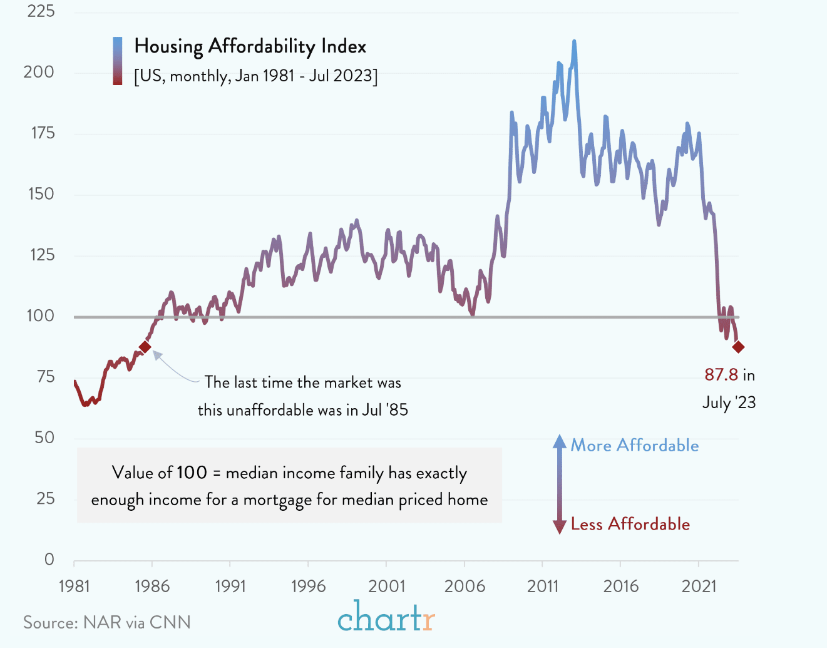

A previous newsletter from Chartr also shared: that the housing market is the least affordable it’s been for decades! The National Association of Realtors’ housing affordability index has dropped to 87.8, the lowest it’s been in nearly four decades. For some perspective, a reading of 100 indicates that a median-income family would have precisely enough to purchase a median-priced home on a 30-year fixed mortgage. At the start of 2021, the same index showed affordability at ~175.

Emphasizing the point, this Fortune article shares that the housing market is so unaffordable that buyers need to make nearly $115K to afford the average home, and Redfin says—that’s $40k more than average earnings! Additionally, monthly mortgage payments reached an all-time high of more than $2,800 per month per Redfin data. (Redfin’s reporting takes into account income, average monthly mortgage payments, and current mortgage rates.)

But what is the outlook?

With buyers and sellers equally gone, we have low demand and low supply and much less churn with a 15.4 percent drop year-over-year. Cash buyers have pulled back and price adjustments are being made now. Price reductions jumped to 37.5% of active listings in September, blowing by the pre-pandemic highs, as sellers are getting more motivated to sell their homes while buyers have vanished at these prices (data via realtor.com). Anticipate a continuing sellers market though until rates come down and spur people to list their homes and jump into buying. So for now, expect it to be a renters market despite rents also being high! Per the Washington Post: “History suggests that rising interest rates aren’t enough to permanently impair housing transactions. Rising mortgage rates in the late 1970s and early 1980s temporarily slowed housing activity, but the market found its footing once inflation settled down and interest rates stabilized. Housing activity and Americans being on the move may be on pause for now, but don’t bet on it lasting.”

At the same time, Fortune Magazine just shared an article where they explain that the housing market affordability is so bad that Zillow says it will take you 13.5 years to break even on a purchase from July onward. Obviously, every homeowner situation is a bit different but several factors go into determining how long it’ll take for a homeowner to break even on their house, including her mortgage rate, down payment amount, closing costs, insurance, property taxes, and annual appreciation rate. While people have other reasons for buying and selling a home, this will have a slowdown effect on the market.